How can corporates engage in venturing?

Tldr: Various venturing alternatives for corporates are illustrated and discussed in this article. There is not THE one best solution to create ventures, it’s dependent on the goals. Different venturing alternatives should be located at the top of an organization and under one central steering.

Throughout the last 7 years, I had the chance to work within various innovation projects at one of the world’s largest automotive companies. I can tell you, that intrapreneurship is a tough game and for sure does not come easy. During this time, I was lucky to experience various organizational set-ups to ship new ventures to the market - e.g. innovation from the internal marketing department, interdisciplinary team, innovation lab and so on. When looking at the different companies today, you see many of these different organizational models reoccur and some new alternatives are on their rise. With this article, I want to give a quick overview on the different alternatives that established companies can choose from. At the end, it is not about one single best alternative for every case. It is very important for managers to lead the different venturing activities based on their potential outcomes.

Companies setup different organizations to create new ventures

To organize the different alternatives, I choose an inside/outside view to distinguish between alternatives. I see these alternatives to be on a continuum between creation of new ventures inside of the company and the creation of new ventures outside the company. At the one extreme, we see very often ventures that get initiated by newly formed innovation departments or already established departments e.g. R&D or Marketing. The idea behind these departments is to have them close to the core of the organization, so that they can leverage the resources and assets that a company has established throughout the last years. On the other side of the continuum is a totally outside venture creation. BMW is running an approach called BMW Startup Garage, where the basic idea from BMW is to become the first client of the Startups. This supplier/customer relationship provides BMW early with the newest ideas and products and a startup with a first real deal. Another way of a pure supplier/customer relation with a new venture can be the provision of a company’s assets via e.g. an API.

In the middle of the continuum between internal venturing and external venturing are multiple alternatives with stronger involvement of an established company or less involvement of an established company. I would distinguish from left to right on the continuum:

Venturing alternatives differ regarding the entry time of corporates

These different venturing alternatives vary at first from the moment when an established company starts to interact with the new venture. For this timing discussion, I would propose to use the Venture Pyramid, that signals the progress on a venture. The Venture Pyramid allows innovators and stakeholders to track the progress on a venture. This means for example, that a company is involved via its innovation department very early in the ideation for a venture. Venture Clienting typically happens, when an external venture has already developed an MVP. Same is true for Venture Capitalists. VCs want to see some traction on a venture. No one will invest only in an idea or into an attractive market. Accelerators, whether internal or external can also start based on an idea, an attractive market or a validated program, but they very often also start with an initial idea. Throughout many accelerator programs, startups are asked to validate their problem and their solution(s).

When should I run the venture inside or outside the corporation?

*Platform businesses have not been in focus by Hagel/Singer (1999), but do strongly differ from a Product Innovation Business, a Customer Relationship Business or a Infrastructure Business.

So, it’s clear that a company has different interaction points with a potential venture. But what is even more important for the management of the alternatives is that they vary in their potential. There are various studies on integrating or separating innovation activities. This research on the “integration and separation decision” shows in which situations some of the developments are superior than others. See below some thoughts of giants put together.

Whereas Christensen, Markides and Hagel/Singer show that the decision for running a new venture inside or outside the corporation is focused on the content of the venture, Govindarajan/Trimble suggest, that it depends on the process and the changes in operating rhythm, power inside the company and so on.

To simplify, I focus here on a distinction between disruptive and sustaining innovation, which I define as a mismatch between the content/process of the established company and the new venture. Thus, whenever a new venture is disruptive to the business of the established company, a company should strive to separate the venturing activities, whereas a venture that promises evolution on an established track should be created with a stronger internal focus. One reason why so many innovation labs or innovation outposts are struggling or closed after a small while is the focus on the inadequate types of innovation. Innovation Labs and outposts need a stronger degree of independence, if they are aiming towards disruptive innovation. If you give the innovation department the order to create disruptive innovations, it will not work and you are going to frustrate not only yourself, but also your team(s). It is also very clear, that an external accelerator will not be the best alternative to create incremental and sustaining progress.

For an overall evaluation, of a venture alternative, it is important to consider the required resources and potential side effects. Some of the alternatives are much faster to implement, others have a greater impact on the overall transformation of a company. Moreover, the more outside the venture is operated, the lower the influence on strategy and control of resources. One factor in addition is the strengthening of an employer brand. An internal accelerator can attract skilled talent to be part of the company. Activities of a Venture Capitalist are very unlikely to boost the employer brand of a corporation.

Expectation Management and Success Factors

I want to highlight below the differences of the venturing alternatives regarding the expectations that you can have, expectations that you shouldn't have and the success factors of each venturing alternative. If you want to find out how your Innovation Lab can perform more like a startup, click here.

Successful corporate venturing requires a conscious management of the venturing alternatives

Believe it or not, there is not just one way to corporate innovation success. It’s all about managing a portfolio of different ventures and their organizational forms. All the different venturing alternative vary in their success factors. The most critical part is to know the potential and the success factors of a venturing alternative. Based on the different potentials and success factors, the venturing alternatives require a different management. Giving e.g. an innovation department the objective to create disruptive innovation won’t lead to innovation success, but to frustration in the company.

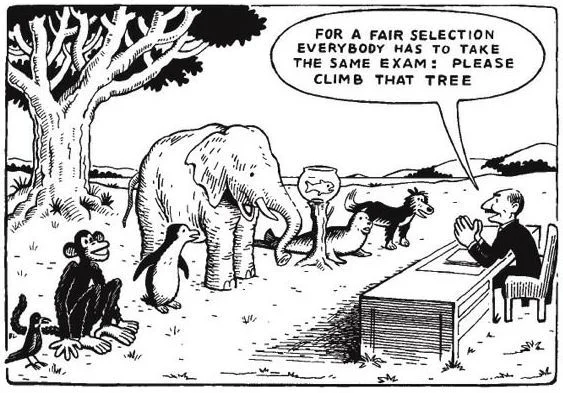

I see it like Einstein, who said:

„Everybody is a genius. But if you judge a fish by its ability to climb a tree, it will live its whole life believing that it is stupid.“

To enable this careful management of venturing alternatives, it is critical that the different forms of venturing are not wildly distributed throughout the company but are all reporting to a C?O. Whether the ? gets replace by Executive, Digital, Innovation, New Business etc., is not that critical. But it is important that the different heads of venturing alternatives are reporting to one boss only.

About Lutz

Dr. Lutz Göcke is the founder of the innovation consultancy Swan Ventures which offers services and SaaS-tools that help you climb the Venture Pyramid with speed and at low cost. Lutz is a Serial-Intrapreneur, Startup-Mentor and a Lecturer on Entrepreneurship, Innovation and Strategic Management.